Performance bonds are an integral part of the construction industry, acting as guarantees that projects will be completed according to specified terms and conditions. In this comprehensive guide, we will delve into the meaning of performance bonds, their significance in construction projects, and how they impact various stakeholders involved.

What is a Performance Bond?

Performance Bond Meaning

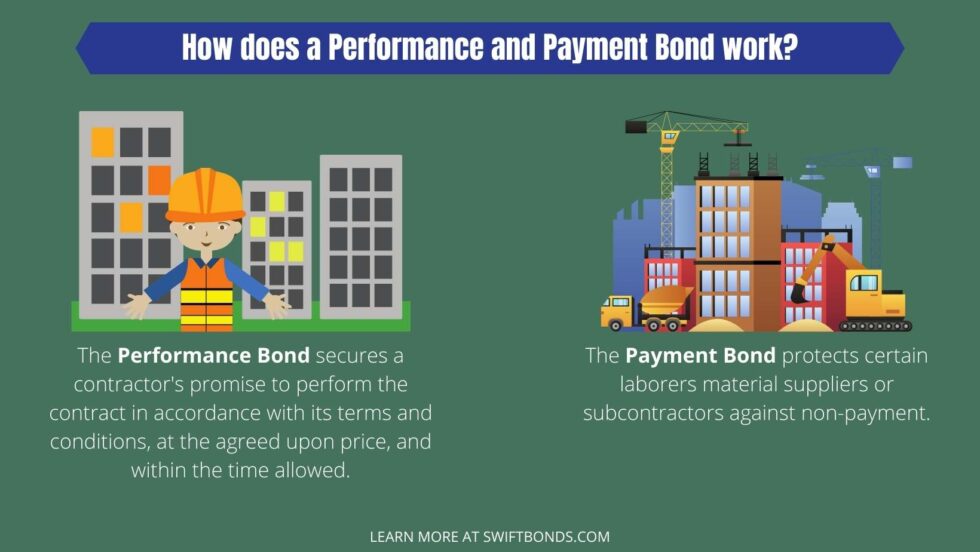

A performance bond is a legally binding agreement between three parties: the obligee (project owner), the principal (contractor), and the surety (bond issuer). It ensures that if the contractor fails to fulfill their contractual obligations, the surety will cover any financial losses incurred by the obligee. Essentially, it serves as a safety net for project owners, ensuring that projects are completed on time and within budget.

Types of Performance Bonds

There are several types of performance bonds that cater to different needs within the construction sector:

- Bid Bonds: These ensure that contractors submit their bids in good faith. Completion Bonds: These guarantee that a project will be completed even if the original contractor defaults. Maintenance Bonds: These provide assurance that any defects will be repaired after project completion for a specified period.

Understanding these various types allows project stakeholders to choose the right bond for their needs.

The Importance of Performance Bonds in Construction Projects

Risk Mitigation

One of the primary roles of performance bonds is risk mitigation. They protect project owners from financial loss caused by contractor defaults. Without such bonds, project owners would bear all risks associated with non-completion or substandard work.

Enhanced Credibility for Contractors

Having a performance bond can enhance a contractor’s credibility. Clients often view bonded contractors as Swiftbonds more reliable since they have undergone rigorous vetting processes by surety companies. This can lead to more contract opportunities and better relationships with clients.

Legal Compliance Requirements

In many jurisdictions, performance bonds are required for public works projects. Governments often mandate them to ensure taxpayer money is safeguarded against contractor failures.

How Do Performance Bonds Work?

The Bonding Process Explained

Application: Contractors apply for a bond through a surety company. Underwriting: The surety evaluates the contractor’s financial stability, experience, and track record. Bond Issuance: Upon approval, the surety issues the bond, which is then presented to the project owner.Claim Process in Case of Default

If a contractor defaults on their obligations:

The project owner notifies the surety about the default. The surety investigates claims made against the bond. If valid, they either ensure project completion or compensate for losses up to the bond's amount.This process underscores why understanding performance bond meaning is crucial for all parties involved in construction projects.

Stakeholders Involved in Performance Bonds

Project Owners: Who Benefits Most?

Project owners are often seen as primary beneficiaries of performance bonds since they provide financial security against potential losses due to contractor failures.

Contractors: A Double-Edged Sword?

While contractors gain credibility through bonding, they also face additional costs associated with securing these bonds. Understanding both sides is essential for contractors navigating this terrain.

Sureties: The Guardian Angels?

Sureties play a pivotal role in evaluating risk and providing coverage. Their underwriting process can serve as an additional layer of scrutiny over contractors’ capabilities.

The Role of Performance Bonds in Construction Projects: Key Benefits and Challenges

Benefits of Performance Bonds

1. Financial Security

Performance bonds offer peace of mind to project owners by ensuring that funds are available should complications arise during construction.

2. Project Completion Assurance

These bonds ensure that projects reach completion despite potential setbacks caused by contractors failing to meet obligations.

3. Encouragement for Quality Work

Knowing there’s oversight from sureties encourages contractors to adhere strictly to quality standards set forth in contracts.

Challenges Associated with Performance Bonds

1. High Costs

The costs associated with obtaining performance bonds can burden smaller contractors who may struggle with cash flow issues.

2. Lengthy Approval Processes

Obtaining a performance bond can involve extensive paperwork and time-consuming underwriting procedures which might delay project initiation.

Performance Bond vs Insurance: Understanding Differences

While both performance bonds and insurance provide protection against risks, they serve different purposes:

- A performance bond guarantees completion or adherence to contract terms. Insurance protects against unforeseen events like accidents or natural disasters affecting ongoing operations.

Understanding these differences helps stakeholders make informed decisions based on specific needs related to risk management strategies.

How Much Does a Performance Bond Cost? Factors Influencing Pricing

Several factors influence how much a performance bond costs:

Contract Size: Larger contracts typically incur higher premiums due to increased risk. Contractor’s Creditworthiness: Strong financial health can lower premiums significantly. Scope of Work: Specialized or complex work often leads to higher bonding costs due to elevated risks involved. Location: Areas prone to economic instability may see higher rates compared to stable regions.Understanding these factors aids contractors in budgeting effectively while considering securing necessary bonding requirements prior to engaging in new projects.

Common Misconceptions About Performance Bonds

1. "All Contracts Require Them"

Not every contract requires a performance bond; private contracts often do not necessitate one unless specified within contractual agreements themselves.

2."They’re Just Another Expense"

While there are costs involved with obtaining these bonds; they ultimately save money by preventing larger financial losses from contractor defaults downline if work were left incomplete or poorly executed without coverage measures established beforehand!

FAQ Section

1. What does “performance bond meaning” entail?

Answer: It refers specifically & broadly speaking–to guarantee issued by third-party entities ensuring contractual obligations met satisfactorily under specified conditions!

2. Are all contractors required to obtain performance bonds?

Answer: No! While public sector projects usually mandate them; many private contracts do not necessitate such requirements unless explicitly stated therein!

3. How long does it take to secure a performance bond?

Answer: Typically involves several days up until weeks depending upon complexity involved during underwriting process including evaluation stages conducted before issuance occurs!

4. Can I get reimbursed if my claim against an established-performance-bond is denied?

Answer: Unfortunately no! Claims must meet certain criteria established beforehand; therefore it’s critical thoroughly review documentation prior submitting requests around validity expectations concerning potential reimbursement scenarios!

5.What happens if my contractor goes bankrupt while working on my project?

Answer: If this occurs you would file claim against existing-performance-bond allowing you access funds needed complete remaining scope without incurring additional losses beyond initial investment made initially!

6.Can I negotiate terms within my own contracts regarding use-performance-bonds?

Answer: Absolutely! As long both parties agree mutually accept modified clauses/conditions pertaining respective responsibilities outlined throughout document agreements signed off upon commencement date commencement when investing in Swiftbonds starting job together collaboratively toward completion end goal successfully achieved!

Conclusion

In conclusion, understanding the role of performance bonds in construction projects cannot be overstated; these instruments protect all stakeholders involved while fostering trustworthiness among those participating across various levels within this intricate industry landscape filled with inherent risks present every step along way! By leveraging proper knowledge surrounding their utility advantages/disadvantages alike – everyone stands benefit greatly reducing uncertainties faced undertaking large-scale developments ultimately leading success outcomes realized collectively over time through collaborative efforts put forth diligently striving achieve milestones set forth originally envisioned together transforming blueprints reality tangible built environment thriving communities flourish across generations ahead!