Introduction

In the realm of business, trust is paramount. However, even the most trustworthy employees can betray that trust, often leading to significant Swiftbonds financial loss. One effective way to safeguard your company against such unfortunate events is through fidelity bonds. These specialized insurance products provide a safety net for businesses by offering protection against losses resulting from employee theft or dishonesty. In this article, we will delve into how fidelity bonds protect your company from employee theft, exploring their importance, functionality, and implementation strategies.

What are Fidelity Bonds?

Understanding Fidelity Bonds

Fidelity bonds are essentially a type of insurance policy designed to protect businesses from losses incurred due to dishonest acts by employees. They cover theft of money, securities, or property committed by an employee while in the course of their employment.

Types of Fidelity Bonds

Employee Dishonesty Bonds: The most common form, these bonds directly address theft or fraud perpetrated by employees. Business Service Bonds: Often used by service providers who send employees into clients’ homes; they cover theft that may occur during service. Blanket Bonds: These cover all employees under one policy without specifying individual names. Specific Bonds: Cover specific individuals identified in the bond agreement.Who Needs a Fidelity Bond?

While any business can benefit from a fidelity bond, those dealing with cash transactions or sensitive information should prioritize securing one. Examples include retail stores, banks, and firms handling client funds.

How Fidelity Bonds Protect Your Company from Employee Theft

Fidelity bonds serve as a crucial line of defense against financial loss due to employee misconduct. But how exactly do they function?

Financial Protection

The primary purpose of a fidelity bond is to provide financial reimbursement for losses incurred due to employee theft. This means that if an employee steals money or assets, the company can file a claim and receive compensation up to the bond's limit.

Risk Mitigation

By having a fidelity bond in place, companies not only protect themselves financially but also signal to potential thieves that they take security seriously. This can deter dishonest behavior among employees who might otherwise consider stealing.

Reputation Management

In today’s competitive market, reputation is everything. A fidelity bond can help maintain customer trust and confidence by demonstrating that you have protective measures in place against employee dishonesty.

Why Every Business Should Consider Fidelity Bonds

Employee Trustworthiness Can Be Deceptive

Even the most seemingly trustworthy employees can engage in dishonest behavior when faced with temptation. A fidelity bond protects companies from the unexpected actions of their workforce.

Insurance Against Financial Losses

Companies face various risks daily; including theft should be viewed as one of them. By investing in a fidelity bond, businesses ensure they are covered for unforeseen losses.

Enhancing Employee Accountability

When employees know they are covered by a fidelity bond, it fosters an environment of accountability and responsibility among team members.

How to Obtain a Fidelity Bond?

Assess Your Needs

Before purchasing a fidelity bond, conduct an internal audit to determine your potential exposure and decide on the amount of coverage needed.

Choose the Right Type of Bond

Selecting the appropriate type of fidelity bond is crucial based on your business model and risk factors associated with your industry.

Work with an Insurance Agent

Consulting with an experienced insurance agent can help you navigate through different options available in the market and find one that best suits your needs.

Cost Factors Influencing Fidelity Bond Premiums

The cost of securing a fidelity bond varies based on several factors:

Type of Bond: Different bonds come with varying premiums. Coverage Amount: Higher coverage limits typically result in higher premiums. Business Size: Larger businesses might pay more due to increased potential risk. Claims History: Companies with prior claims may face higher rates than those without any history of claims related to dishonesty or theft. Employee Background Checks: Conducting thorough background checks on employees may lead to lower premiums as it reduces perceived risk for insurers.Common Misconceptions About Fidelity Bonds

1. Are Fidelity Bonds the Same as Insurance?

While both provide financial protection, fidelity bonds specifically cover losses due to employee dishonesty while standard insurance covers broader risks such as liability and property damage.

2. Do All Employees Need Coverage?

Not necessarily; many companies opt for blanket coverage which encompasses all employees rather than insuring individuals separately unless there’s significant risk associated with specific roles.

FAQs About Fidelity Bonds

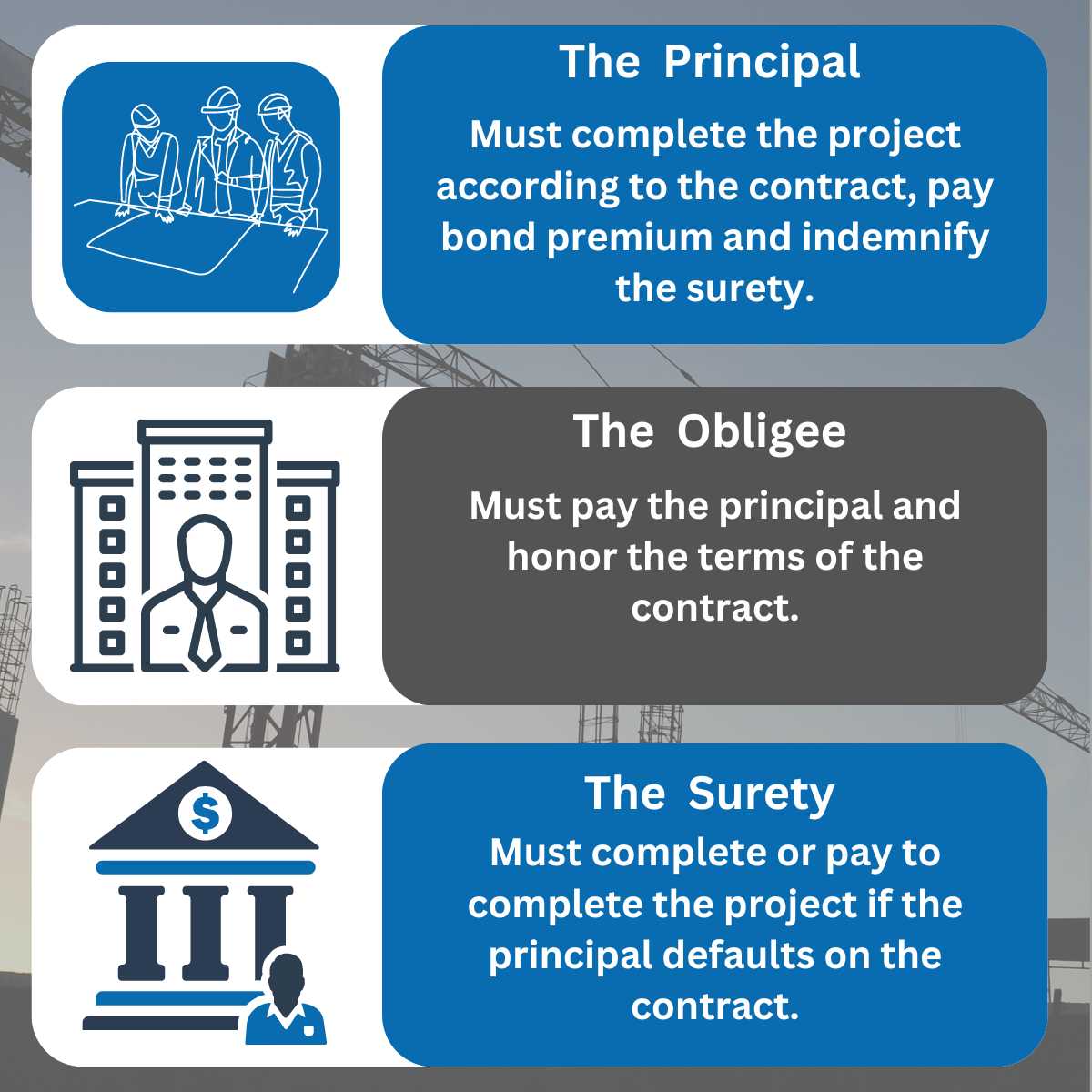

1. What’s the Difference Between a Fidelity Bond and Surety Bond?

A surety bond guarantees performance or compliance (often involving contracts), while a fidelity bond protects against loss caused by dishonest acts such as theft or fraud.

2. How Long Does It Take To Get Approved For A Fidelity Bond?

The approval process typically ranges from a few hours up to several days depending on documentation provided and background checks performed by the bonding company.

Swiftbonds financial services3. Are There Any Limitations To Coverage?

Yes; most bonds have exclusions outlined in their terms which often include acts committed outside regular working hours or losses discovered after termination.

4. Can I Get A Fidelity Bond If My Employees Have Criminal Records?

It largely depends on insurers’ policies regarding previous convictions; however, thorough evaluations will be made before granting coverage approval based on risk assessments conducted during underwriting processes.

5.What Happens If An Employee Steals And The Company Has No Bond?

Without proper bonding protection in place companies bear full financial responsibility for any resulting losses incurred due to employee dishonesty—making it critical for businesses especially those handling large sums regularly invest wisely into securing appropriate safeguards like this!

Conclusion

In conclusion, understanding how fidelity bonds protect your company from employee theft is essential for maintaining financial stability and safeguarding your reputation within your industry landscape! Investing time into assessing specific risks associated within work environments paired alongside implementing appropriate measures such as obtaining reliable bonding solutions will undoubtedly pave pathways toward success! Remember—it’s always better safe than sorry when guarding against unforeseen circumstances arising out workplace dynamics!

This comprehensive exploration underscores not only why every business should consider obtaining a fidelity bond but also emphasizes its overall advantages throughout operational frameworks—ultimately ensuring peace of mind knowing there’s protection available should something go awry unexpectedly!