Introduction

Navigating the world of bonding requirements can feel like walking through a maze without a map. Whether you're a contractor, a real estate agent, or simply someone exploring business opportunities, understanding bonding requirements across different states is crucial. The term “getting bonded” often raises questions about what it entails, why it’s necessary, and how it varies from one state to another. This comprehensive guide, "Bonding Requirements by State: What You Need to Know," aims to provide you with all the information you need to make informed decisions regarding bonding in your state.

Bonding Requirements by State: What You Need to Know

What is Bonding?

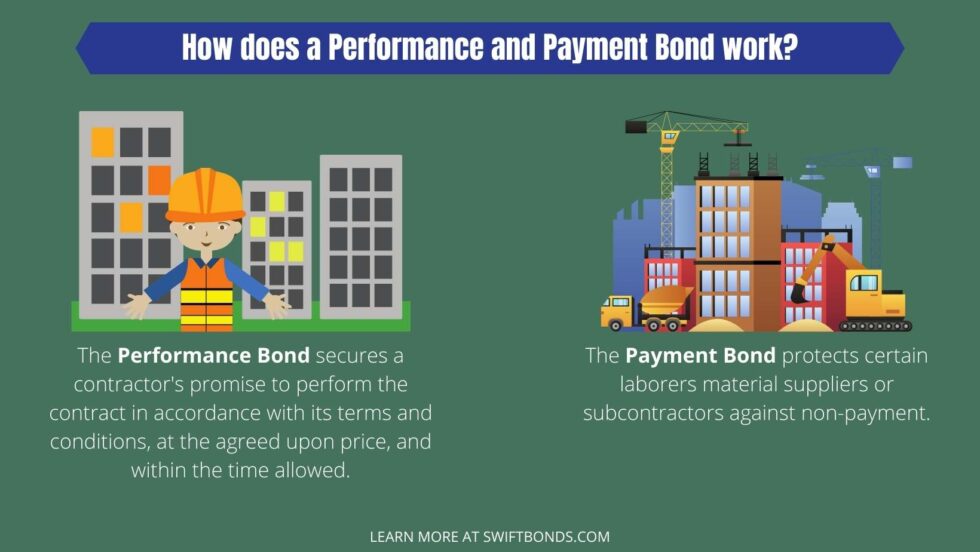

Bonding is essentially a financial guarantee that ensures contractors or businesses fulfill their obligations as outlined in contracts. If they fail to do so, the bond provides a safety net for clients, covering potential losses up to the bond amount.

Types of Bonds

Contractor Bonds: Often required for construction projects. License Bonds: Required for specific professional licenses. Court Bonds: Necessary for legal proceedings. Fidelity Bonds: Protects businesses against employee dishonesty.Why Getting Bonded Matters

Getting bonded not only enhances your credibility but also builds trust with clients. It shows that you are serious about your work and have the financial backing to deliver on your promises.

State-Specific Bonding Requirements

Alabama Bonding Requirements

In Alabama, many contractors must obtain a license bond before starting work on any project exceeding $50,000. This protects clients from incomplete or unsatisfactory work.

Key Points

- Minimum bond amount: $10,000 Licensing authority: Alabama Board of General Contractors

Alaska Bonding Requirements

Alaska requires specific licensing bonds for contractors Swiftbonds working on public projects over $25,000.

Key Points

- Minimum bond amount: $25,000 Licensing authority: Alaska Department of Labor

Arizona Bonding Requirements

In Arizona, general contractors must carry a minimum bond of $1,000.

Key Points

- Licensing authority: Arizona Registrar of Contractors Additional requirements may apply based on project size

Arkansas Bonding Requirements

Contractors in Arkansas are typically required to get bonded if they're bidding on public works projects.

Key Points

- Minimum bond amount varies based on project scope Licensing authority: Arkansas Contractor's Licensing Board

California Bonding Requirements

California has stringent bonding requirements for various trades and professions.

Key Points

- Minimum bond amount ranges from $15,000 to $100,000 Licensing authority varies by profession (e.g., California Contractors State License Board)

Understanding the Process of Getting Bonded

How Do You Get Bonded?

The process typically involves:

Applying through a licensed surety company. Undergoing an assessment of your financial stability and creditworthiness. Paying the premium associated with the bond.Documentation Needed for Getting Bonded

Commonly required documents include:

- Business license Financial statements A completed application form

Bond Amounts and Their Importance

Why Does Bond Amount Matter?

The bond amount represents the maximum liability that the surety will cover if you fail to meet obligations. Higher amounts usually indicate increased trustworthiness and reliability.

Frequently Asked Questions (FAQs)

1. What does getting bonded mean?

Getting bonded means obtaining a surety bond which guarantees your compliance with contractual obligations.

2. How much does it cost to get bonded?

Costs vary based on factors like credit history and bond type but generally range from 1% to 15% of the total bond amount.

3. Can I get bonded with bad credit?

Yes! Some surety companies specialize in providing bonds for individuals with poor credit; however, expect higher premiums.

4. How long is a surety bond valid?

Most surety bonds are valid for one year but can be renewed annually depending on state regulations.

5. What happens if I default on my bond?

If you fail to https://swiftbonds4us.blogspot.com/2025/06/swift-bonds.html meet obligations under your contract, the claimant can file against your bond to recover losses up to its limit.

6. Are there alternatives to getting bonded?

Some businesses might consider insurance policies or self-insured retention agreements; however, these do not substitute for legal bonding requirements in many cases.

Conclusion

Understanding bonding requirements by state is crucial whether you're venturing into construction or any business that requires client trust and accountability. From ensuring compliance with local laws to protecting both parties involved in contracts, being knowledgeable about bonding helps mitigate risks associated with business operations effectively. Remember that getting bonded not only safeguards you but also builds credibility among potential clients—an invaluable asset in today’s competitive marketplace!

By familiarizing yourself with "Bonding Requirements by State: What You Need to Know," you're taking a significant step towards establishing yourself as a reliable business entity while ensuring financial security against potential risks associated with contractual obligations across different states.

This article should serve as an extensive resource for anyone seeking detailed insights into bonding requirements across various jurisdictions while aiming at achieving better understanding and compliance within their respective fields or industries.